Tom Lee’s BitMine Immersion Technologies could be buying Ethereum, according to on-chain data. Specifically, Arkham Intelligence highlighted a massive acquisition done in a familiar pattern, noting it could belong to the Tom Lee-chaired Ethereum treasury company.

Three New Whales Buy the Dip

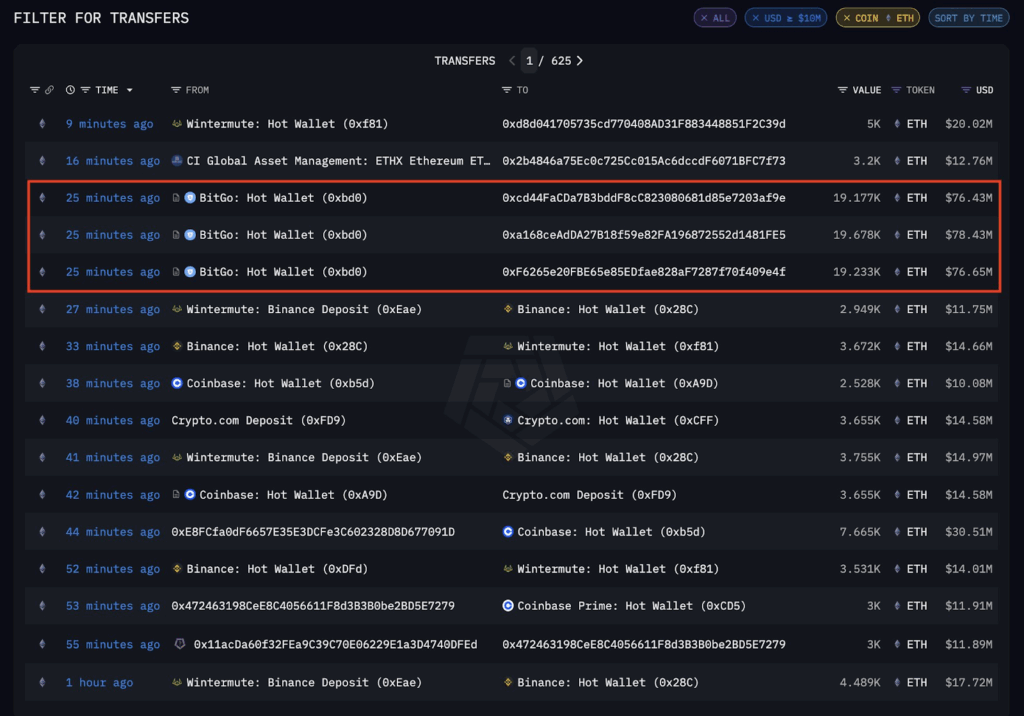

According to the data, three new wallet addresses, “0xcd44F,” “0xa168,” and “0xF626,” purchased 19,177 ETH ($76.4 million), 19,678 ETH ($88.4 million), and 19,233 ETH ($78.65 million), respectively. They bought the combined $231 million worth of Ethereum from crypto exchange BitGo.

Arkham suggested it belonged to Tom Lee’s BitMine because it resembled their pattern of accumulation. In several instances, the digital asset treasury firm has used new wallets to acquire Ether over the week before announcing its total purchases on Tuesdays.

Meanwhile, this acquisition comes as the broader cryptocurrency market continues to correct. Ethereum has joined this trend, falling below the psychological $4,000 price level. The token is down over 4% since the start of October, giving up all the upside from its push to $4,757 earlier.

BitMine’s supposed purchases signal institutional interest in Ethereum despite the recent correction. The dip-buying plight further reestablishes confidence among Ethereum holders, signaling that whales are still keen on bullish development in both the short-term and long-term.

BitMine Cuts Down Average Entry

The Tuesday purchase disclosure shows that BitMine now holds 3,032,188 ETH acquired at an average price of $4,154 per coin. While this remains below the current market price, it continues to move downwards, as BitMine uses the dip to buy cheaper.

Meanwhile, BitMine plans to keep buying Ethereum, taking a page from Michael Saylor’s Strategy. With over 2% of Ethereum’s total supply already achieved. The plan is to continue raising capital to buy Ethereum, aiming to reach at least 5%.

Data shows that BitMine is the largest Ethereum treasury company but the second largest among all digital asset holders. Strategy outranks the firm, holding over 640,000 BTC valued at over $79 million.

Beyond Ethereum, Here’s Another Life-Changing Opportunity

Ethereum might have more upside, but whales might be seeking new alternatives, one with a 100-fold potential. One of them is Minotaurus (MTAUR), an asset that has shown life-changing prospects, similar to those of Bitcoin and Ethereum in their early days.

Meanwhile, the trending asset has use cases identical to those of BTC and ETH, but within the casual gaming ecosystem. Notably, analysis suggests that the sector will expand to a $29 billion industry by 2029, and Minotaurus (MTAUR) is positioning itself as a leader in the industry.

Currently selling at 0.00012464 USDT, Minotaurus offers not just a fair entry but also an affordable price to accumulate, considering its future trajectory.

For instance, one can acquire over 800,000 MTAUR with 100 USDT at the current market price. If MTAUR rallies to 1 USDT, as many predict, the purchase would turn into over 8 million USDT. Buy MTAUR here.

Attention! The information presented in this article does not constitute investment advice. Before purchasing any cryptocurrency, always conduct thorough research and make sure you are well informed about the specific asset!

(This article was provided by the third party.)

(Cover photo: AI generated)